A BYD Forklift's "Cost-effectiveness"

Under the influence of the "dual carbon" goals, emission standards have been upgraded, and some provinces in China have introduced relevant policies such as "oil-to-electricity" and "oil-to-battery" to promote the application of electric new energy products. In Gongshu District, Hangzhou City, a company received a government subsidy of 24,000 yuan and became the first enterprise to actively respond to the elimination and replacement of old diesel forklifts. On one hand, there are daunting high oil prices, and on the other hand, there are substantial subsidies for new energy. Which one to choose? I believe everyone already has an answer.

In recent years, domestic internal combustion forklifts have experienced continuous negative growth, while the sales volume of electric forklifts has steadily increased. At the same time, the sales volume of electric counterbalanced forklifts and AGV categories has grown rapidly, accelerating the structural changes and upgrading demands of industrial vehicle products.

The forklift industry seems to be "changing times"...

01

Seizing the opportunity, rising with the tide

After seventy years of ups and downs, the Chinese forklift market has been turbulent. From the absence of high-end products to the melee of low-end products, the industry has shifted from "manufacturing forklifts" to "producing excellent forklifts." Traditional internal combustion forklift manufacturers have made remarkable progress and gradually gained a foothold in the forklift market, with distribution channels extending from first-tier cities to city and county markets. However, beneath the thick ice, there are hidden undercurrents, and the forklift industry is not calm.

As the saying goes, "One can tell the coming of autumn from a single falling leaf." Numerous signs have indicated that the positions of some traditional leading brands are being shaken. Previously, influenced by the three-year pandemic, the construction machinery industry faced downward pressure in the cycle, and the overall market development was weak. In such an environment, we still see BYD forklifts achieve sales growth against the trend. Undoubtedly, BYD's new energy forklifts have already made a significant impact in the field of logistics handling machinery. However, "talented individuals emerge in every generation." In this booming trend of the rise of new energy forklifts, competition and challenges are still everywhere.

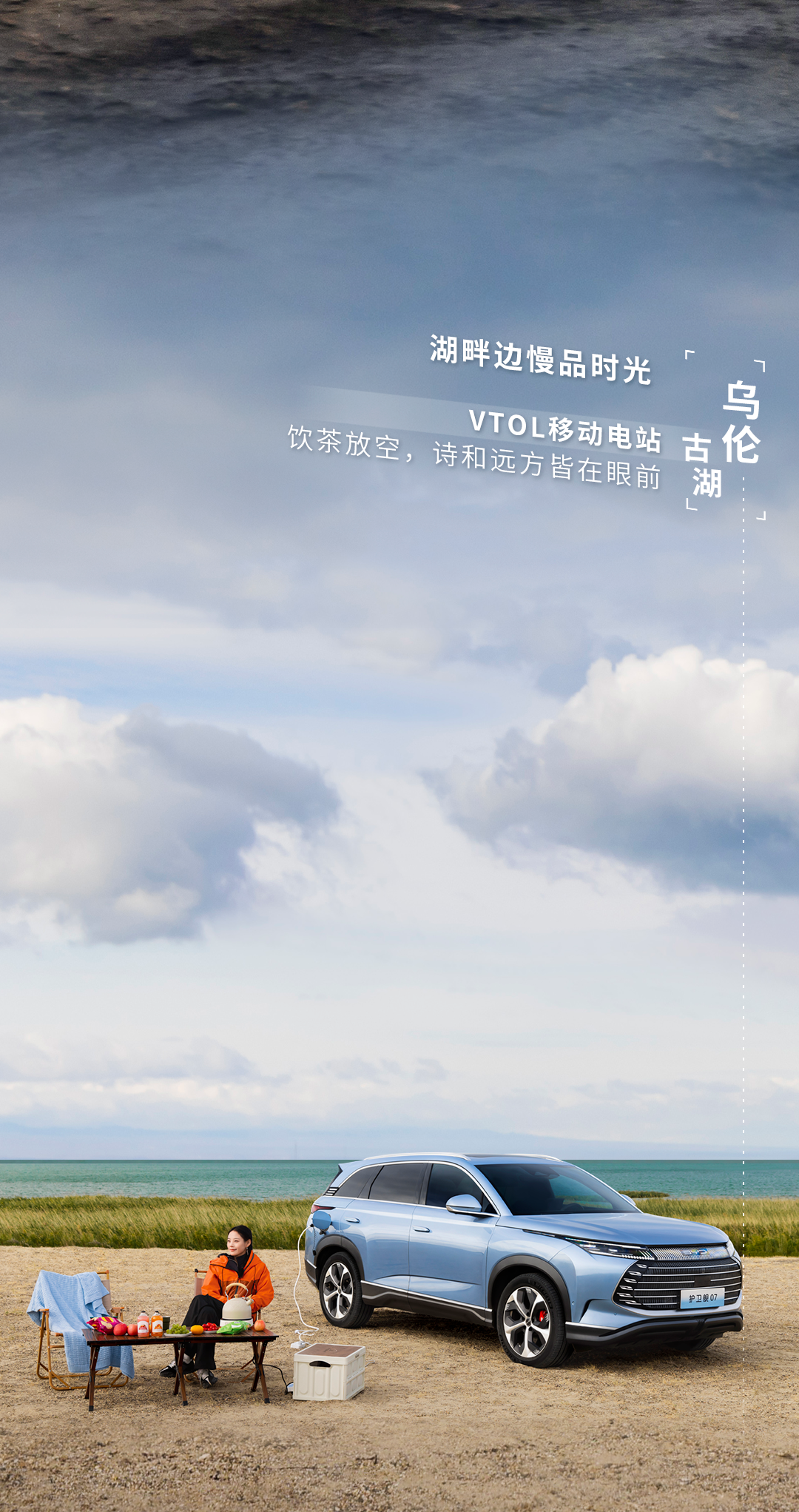

BYD forklift in warehouse operations

BYD forklift in warehouse operations

02

Unique insight, competing at the forefront

No one is an eternal victor, but there are always those who achieve victory.

With the peak of internet consumption, the warehousing and logistics industry is flourishing. To maximize warehouse storage efficiency, many logistics companies are narrowing down logistics channels, making it impossible for large fuel-powered forklifts to enter, while small manual forklifts struggle to handle more goods.

Addressing the pain points of the industry, BYD Forklift has redefined its target market and launched a 5-ton lithium-ion forklift with a full load climbing capacity of up to 20% and a travel speed of 18 km/h. So far, it has become a popular product series in industries such as papermaking and brewing. Subsequently, BYD introduced the Blue Ant series of forklifts, with a body width of only 685mm and a turning radius of 1360mm. According to user feedback, "BYD forklifts have lower operating costs than fuel-powered forklifts, and they can be fully charged in as little as 1 hour. After three to five years of use, the overall cost advantage becomes even more apparent."

BYD forklift in port operations

BYD forklift in port operations

As industrial vehicles enter the era of lightness, BYD Forklift promptly launched the lightweight "F" series lithium-ion counterbalanced forklifts. If optimizing traditional forklift usage habits and application scenarios demonstrate BYD Forklift's courage and strength, then "tailoring to fit" and customized solutions to reduce costs and increase efficiency for customers are the source of BYD Forklift's confidence.

03

Forward-looking vision, expanding the market

In recent years, Chinese companies have been actively expanding overseas. From independently developed electric vehicles to trendy toys that integrate art and commerce, and even to 9.9 yuan cups of coffee, an increasing number of Chinese brands are accelerating their global presence. BYD Forklift understands this trend well and made early preparations. Many years ago, it had already developed a complete and mature product line to meet the diverse and personalized needs of global customers. It has also established research and development centers in Europe, North America, and Asia, and tailored new energy forklifts for different market segments based on user demands.

According to previous reports, Norway and the Netherlands have announced that they will ban the sale of fossil fuel-powered vehicles from 2025, and countries such as France and Spain have also announced plans to gradually phase out such vehicles by 2035. This confirms that BYD Forklift's far-sightedness has once again given it an advantage in the wave of internationalization.

BYD Forklift continues to adapt to changes, driven by innovation, and strides forward. Its fascinating story is just beginning to unfold in the surging market tide and ever-changing competitive environment.

The above is the full content of A BYD Forklift's "Cost-effectiveness"