A Decade in Vain: Why Did Apple Abandon Car Manufacturing?

After ten years, Apple's venture into the automotive industry has turned out to be an unfulfilled dream.

On February 28th, Bloomberg confirmed that Apple has finally abandoned its electric car project, which had been in development for approximately a decade. The reason behind Apple's decision to abandon the electric car project might be attributed to the intense competition and market saturation in the current electric vehicle industry. Releasing an L2+ vehicle by 2028 would not have been competitive enough, so Apple chose to cut its losses rather than wasting resources.

Considering that the electric vehicle sector is one of the few industries in the technology field with promising growth prospects, Apple's decision to abandon the electric car project indicates a narrowing of its imagination. Moving forward, Apple needs to swiftly explore more sustainable technologies and products.

01

Difficulties in Achieving Level 5 Autonomous Driving

It is undeniable that the difficulties faced by the Apple Car project were largely due to strategic realignments and frequent changes in leadership.

According to incomplete statistics, since 2014, the Apple Car project has undergone four changes in leadership and has oscillated between the goals of producing mass-market vehicles and achieving fully autonomous driving capability.

As a global technology leader, Apple is well aware of the negative impact that changing leaders and strategies can have on a business. Thus, Apple's electric car project faced continuous fluctuations because the company aimed to create a differentiated product that would yield higher profits.

Reviewing the successful products Apple has launched over the past few decades, such as the iPod, iPhone, and iPad, it is evident that their greatest feature is their distinctiveness and irreplaceability. Based on this foundation, Apple was able to capture a significant portion of industry profits.

Take the iPhone, for example. Before the iPhone's introduction, there were already numerous smartphones in the market. However, the iPhone revolutionized the smartphone industry by offering consumers a new user experience through features like touchscreen, the App Store, and integration with iPod functionalities.

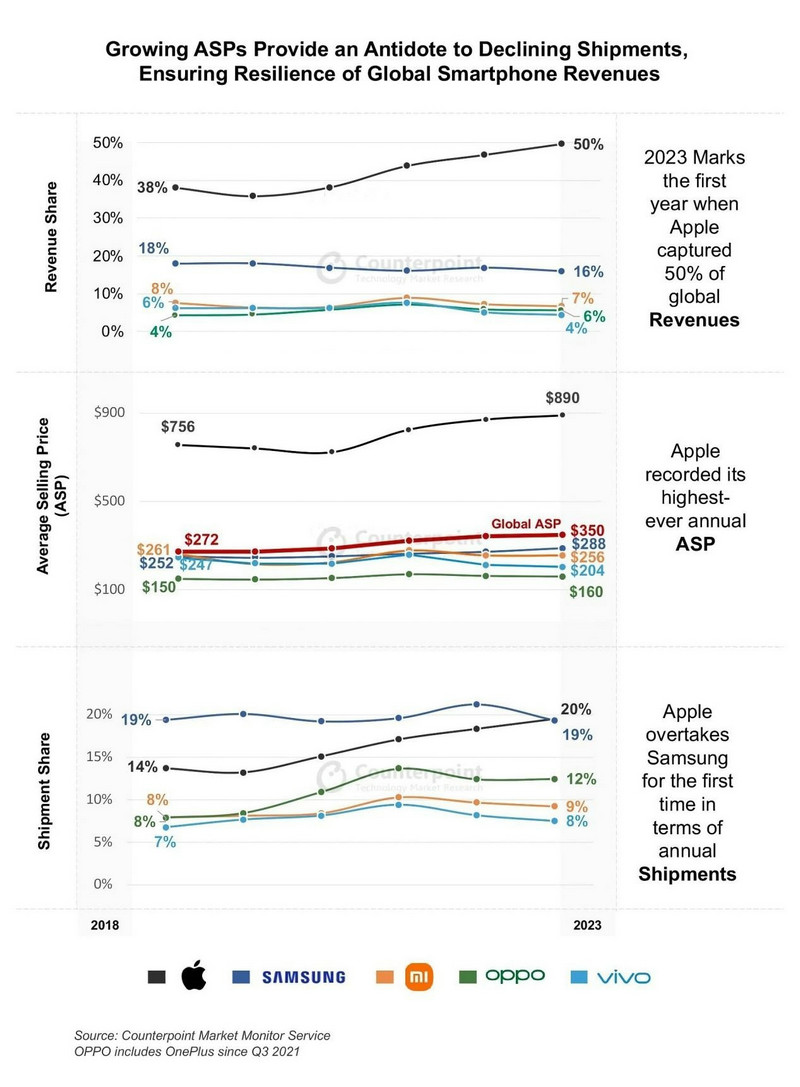

Growing ASPs Provide an Antidote to Declining Shipments,Ensuring Resilience of Global Smartphone Revenues

Growing ASPs Provide an Antidote to Declining Shipments,Ensuring Resilience of Global Smartphone Revenues

In the following years, although Android smartphone manufacturers caught up, iPhone maintained high profit margins due to its A-series processors, closed ecosystem, and superior stability. According to data from Counterpoint, in 2023, the iPhone accounted for 50% of global smartphone sales revenue and captured over 90% of profits.

In the era of electric vehicles, Apple naturally wanted to continue the success of products like the iPod, iPhone, and iPad. By leveraging cutting-edge technology, Apple aimed to disrupt the entire industry and achieve higher profits.

Despite the numerous adjustments made to the Apple Car project, the company's strategic goal became clear after 2016, which was to focus on achieving fully autonomous driving technology.

During a financial earnings conference in 2016, Apple CEO Tim Cook stated, "Apple is investing heavily in autonomous systems, and we are very focused on autonomous systems from a core technology point of view." In late 2021, Bloomberg reported that Apple Vice President Kevin Lynch was leading a team to develop an L5 autonomous driving car.

Therefore, in the previous years, Apple's ambition for its car business was to release a fully autonomous vehicle ahead of other automakers and become the "monopolist" in the industry's profits.

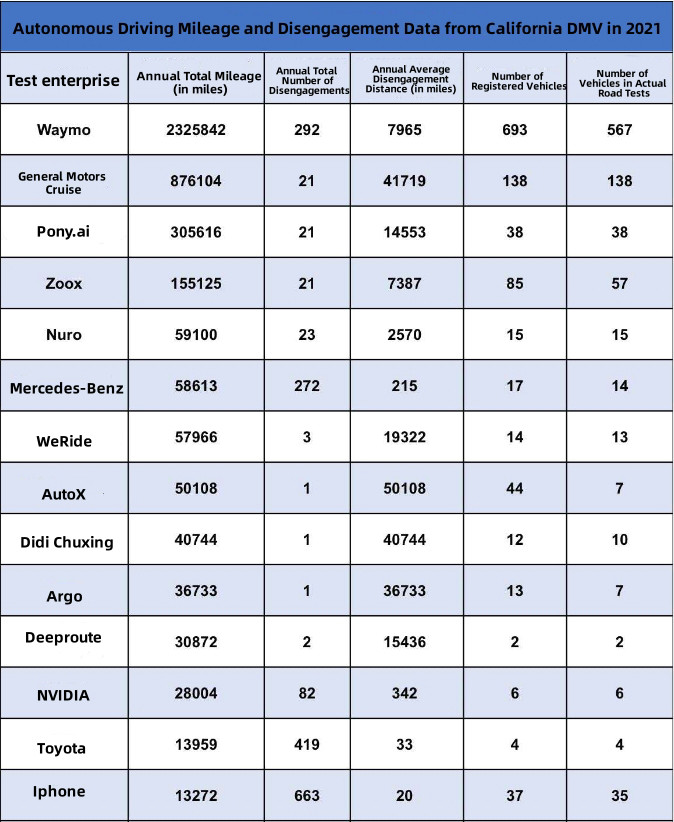

Autonomous Driving Mileage and Disengagement Data from California DMV in 2021

Autonomous Driving Mileage and Disengagement Data from California DMV in 2021

Unfortunately, Apple underestimated the challenges of realizing fully autonomous driving technology. According to data from the California Department of Motor Vehicles (DMV) regarding autonomous driving miles and disengagements in 2021, Apple's autonomous vehicles had a disengagement rate of 663 incidents, ranking the lowest among all companies submitting testing reports.

In fact, not only did Apple rank last in tests conducted by authoritative institutions, but its autonomous vehicles were also involved in multiple accidents. According to data disclosed by macReports, there were a total of 16 accidents involving Apple's autonomous vehicles around March 2023.

The reason why Apple's envisioned autonomous vehicle, supporting fully autonomous driving technology, did not materialize as promptly as the iPod or iPhone is mainly because achieving fully autonomous driving is not simply a matter of innovative features and ecosystem. It requires abundant computing power, precise perception capabilities, and flexible decision-making. Currently, there is still a significant technological gap in the industry to achieve these goals.

In response to this, during the 2024 BYD Dream Day event, BYD Chairman Wang Chuanfu stated, "At the current stage, self-driving technology does not have the necessary conditions to be implemented, either in terms of legal regulations or technological maturity."

02

Unacceptable Price Wars and Intense Competition

It was only in January 2024 that Apple adjusted its autonomous driving level target for its car project to L2+ after realizing that achieving full autonomous driving technology in the short term was challenging.

However, just one month after aligning its autonomous driving technology target with the industry's normal level, Apple chose to halt its car manufacturing altogether. This decision might be attributed to Apple's realization that launching an L2+ electric vehicle in 2028 would not only fail to disrupt the industry but could also potentially entangle the company in a price war.

In recent years, as technology has matured and consumer acceptance has increased, the intelligent driving technology of new energy vehicles has rapidly developed. For example, prior to the 2024 Chinese New Year, Huawei pushed the National City Area Navigation (NCA) to all owners of the Wanjie M5 and M7 intelligent driving versions who subscribed to the ADS2.0 advanced feature package.

During the 2023 financial report conference, IDEAL CEO Li Xiang revealed that they expected to achieve nationwide availability of the map-free version of Urban NOA in the second quarter of 2024, further enhancing their Urban NOA capabilities. On March 1st, 2024, XPeng pushed the XNGP intelligent assisted driving function to its intelligent driving users.

With a massive amount of data available for iteration, the intelligent driving technology of emerging car manufacturers will continue to develop rapidly. In June 2023, Huawei's CEO, Richard Yu, stated that Huawei aims to achieve commercial use of Level 3 autonomous driving by 2025 and Level 4 autonomous driving by 2030.

In comparison, Apple's plan to launch a new energy vehicle with only L2+ autonomous driving support by 2028 would have put them significantly behind the competition. It is evident that such a vehicle, which might not even be on the market yet, would have a difficult time becoming the "iPhone" of the automotive era.

What's even more pessimistic is that as most consumers choose new energy vehicles, the related market dividends will gradually diminish, leaving Apple with a narrower development space.

Ouyang Ming, Vice Chairman of the China Association of Automobile Manufacturers, predicts that by 2030, the market penetration rate of new energy vehicles in China will reach 70%. Referring to the experiences of the PC and mobile phone industries, as the penetration rate of products increases, it also indicates that the industry will enter an era of oligopoly.

Seeing the end of industry dividends, many car manufacturers have resorted to price wars in order to quickly seize market share and expand their brand influence.

For example, BYD, Wuling, and Qiyuan have recently launched price reductions for new energy vehicles priced below 100,000 RMB. On February 28th, 2024, the BYD Han Honor Edition was launched with a starting price of only 169,800 RMB. On March 1st, the all-new Jike 001 was released, with a cost increase of 50,000 RMB per vehicle but with no change in the selling price.

Considering that Apple's car does not possess an absolute core competitiveness, once it enters the market, it would face fierce price wars and would struggle to capture a significant portion of the industry's profits, similar to what the iPhone achieved. For Apple, completely abandoning the car project is clearly a wise move.

03

AI, Apple's Last Ticket

Apple's decision to abandon its car project certainly has valid reasons, but as a technology company, giving up on the industry with the greatest growth prospects in the current tech industry has also narrowed Apple's imagination and made it unattractive to the capital market. After Bloomberg exposed the news of Apple abandoning its electric car project, Apple's stock price continued to decline, with a cumulative decrease of 0.96%.

Of course, some investors are bearish on Apple not only because the company has given up on a business with great growth potential but also because Apple's fundamentals have reached their peak and it will be difficult for the company to sustain its growth.

The financial report for the first quarter of the 2024 fiscal year showed that Apple's revenue was $119.6 billion, with a year-on-year growth of only 2%. iPhone revenue was $69.7 billion, with a year-on-year growth of only 6%. Sales in Greater China amounted to $20.819 billion, a year-on-year decline of 13%. Due to intensified market competition and a lack of innovation, the appeal of the iPhone to consumers continues to decline, making it difficult for Apple's performance to continue to rise.

In fact, most smartphone manufacturers are currently facing similar challenges. Take Xiaomi as an example, its revenue in the first three quarters of 2023 was 197.7 billion yuan, a year-on-year decrease of 7.6%. In order to open up growth space, Xiaomi has been laying out its automotive business for three years. The Xiaomi Car SU7 is scheduled to be launched in the second quarter of 2024.

However, as mentioned earlier, Apple has strategically abandoned its car manufacturing, so it needs to explore other more growth-oriented businesses. Currently, Apple is targeting AI technology.

According to Mark Gurman's revelations, key personnel from Apple's car business have been prioritized for the development of generative AI projects. At the annual shareholders' meeting, Tim Cook also stated that generative AI has incredible potential and that Apple has made "huge investments" in the field. Apple is expected to share "new breakthroughs" in AI technology later this year.

In fact, considering the macro trend, with the popularity of ChatGPT, AI technology does have tremendous commercial value. IDC data shows that the global AI software market was worth $64 billion in 2022 and is expected to reach $279 billion in 2027, with a compound annual growth rate of 31.4%.

With hundreds of millions of terminals and a high regard for privacy, Apple's AI technology may not be cloud-centric like Microsoft and Google, but rather relies on edge computing power. For example, at the end of 2023, Apple announced the open-source M-chip dedicated ML framework, which can be directly used to train large models with 7 billion parameters. Industry insiders speculate that Apple's move is to prepare for the development of generative AI applications on Mac.

Although many terminals can achieve functions such as natural language conversation and enhanced photography based on edge computing power, the computing power ceiling of portable terminals is actually quite low due to size and battery life limitations.

According to research reports disclosed by MediaTek, the computing power of flagship smartphones in 2023 is about 40TOPS-50TOPS, with a memory capacity of about 16GB and a memory bandwidth of about 50GB/s. However, a large-scale edge model with 13 billion parameters would require at least 13GB of memory and a bandwidth of 130GB/s.

It is obvious that current smart terminals, whether in terms of computing power, memory capacity, or memory bandwidth, are unable to meet the needs of large-scale edge models with 13 billion parameters, making it difficult to provide consumers with revolutionary experiential enhancements.

04

Conclusion

In summary, Apple's decision to abandon its car project, which it has been working on for over a decade, is not accidental. Based on previous experiences, Apple's primary goal when entering a new industry is to enhance product premium through revolutionary technology and capture a significant portion of the industry's profits.

With many emerging car manufacturers actively developing intelligent driving technology and the diminishing market dividends of new energy vehicles, Apple's car would have been significantly behind its competitors in terms of product capabilities, making it difficult to achieve impressive performance.

Although Apple is now targeting more imaginative AI technology, its main products such as smartphones, tablets, and computers have limited computing power and battery life, making it difficult to provide consumers with an AI experience comparable to cloud-based AI technology.

Apple may have a "long season" ahead of it.

The above is the full content of A Decade in Vain: Why Did Apple Abandon Car Manufacturing?