Why is Tesla stock dropping?

Key Points:

1.Tesla's current performance decline is not due to its own problems but rather being caught between the Chinese and Western automobile industries and government policies.

2.Tesla's strategy of building popular models through a limited range of vehicle models and reducing costs through cumulative sales is a practical choice. However, this model is destined to fail in the Chinese market.

3.Initiatives such as the new pickup truck and continued price reductions to boost sales cannot change Tesla's downward trend in 2024. Its performance is expected to further decline.

Entering 2024, Tesla has encountered a "Waterloo" in terms of market value.

Its stock price, which was above $175, has dropped over 30% compared to the end of 2023, when it was over $260. In fact, back in October 2023, when Tesla announced financial results significantly below market expectations, its stock price experienced a 23% decline.

Although it eventually experienced a rapid rebound due to the strong overall performance of the U.S. stock market and the popularity of Tesla's self-developed Optimus robot, the "support" disappeared instantly after the announcement of the fourth-quarter earnings report at the end of January this year.

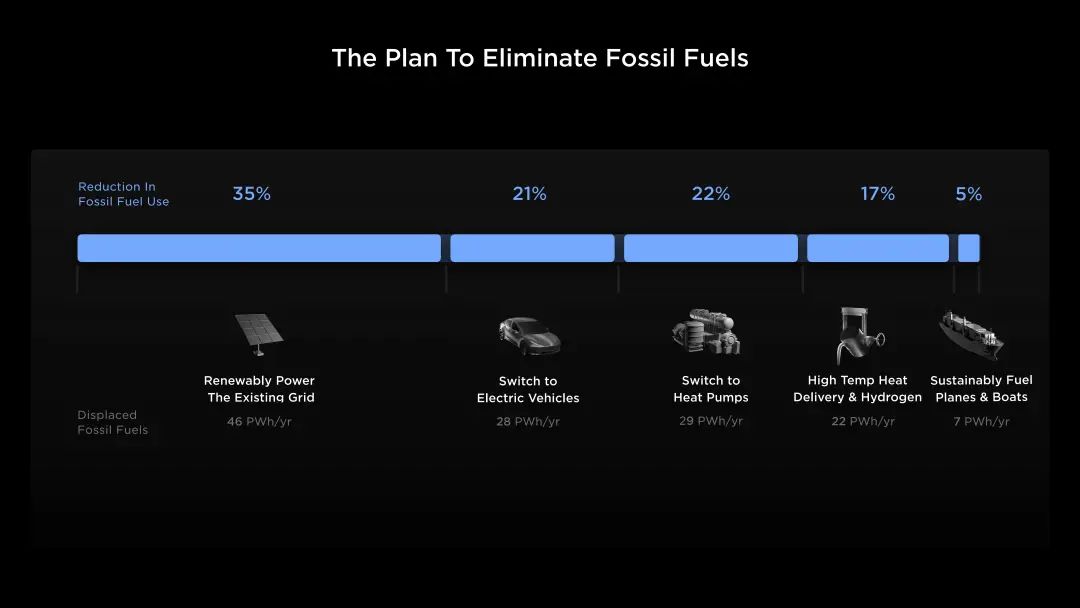

Tesla quarterly financial report trend

Tesla quarterly financial report trend

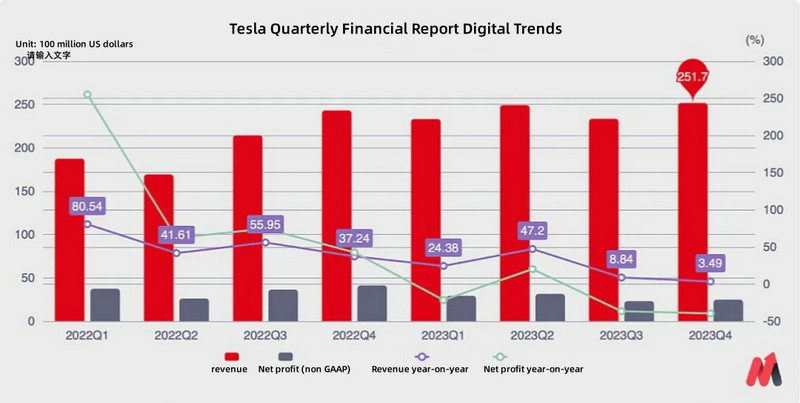

Tesla quarterly financial report rolling value trend

Tesla quarterly financial report rolling value trend

2023 saw consecutive single-digit year-on-year revenue growth for Tesla in the third and fourth quarters, along with a significant decline in net profit, which appears to be "bad enough." Applying the author's commonly used method of calculating annual rolling values that better reflect long-term trends, the changing trend in Tesla's financial results becomes more apparent. Although revenue is still growing, its net profit has entered a new phase of negative year-on-year rolling values since the third quarter of 2023.

The reasons for the profit decline are not a secret either: in 2023, Tesla reduced prices globally, voluntarily compressing its profit margins.

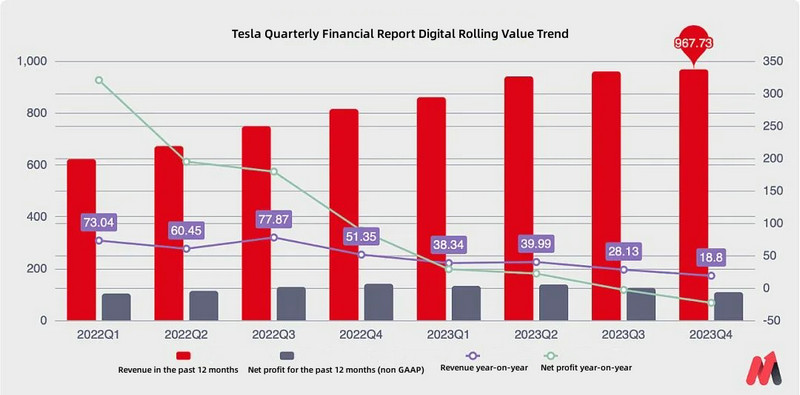

Specific Revenue of Tesla's Automotive Business

Specific Revenue of Tesla's Automotive Business

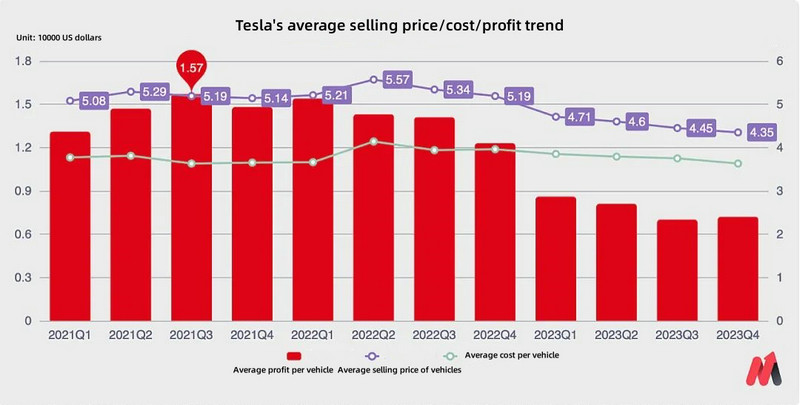

Trend of Tesla's Average Selling Price/Cost/Profit per Vehicle

Trend of Tesla's Average Selling Price/Cost/Profit per Vehicle

Looking at the changes in average cost and selling price per vehicle, taking the fourth quarter of 2023 as an example, Tesla's global average cost per vehicle decreased by 8.3%, but the selling price actually decreased by 16.3%.

The changes in per-vehicle profit, multiplied by Tesla's overall large sales volume, ultimately resulted in a decrease in gross profit margin from 26.2% for the entire previous year to 17.0% in 2023, despite a nearly 17% increase in annual automotive sales revenue. The gross profit amount decreased by over $4 billion, and the company's overall net profit decreased by $3.23 billion.

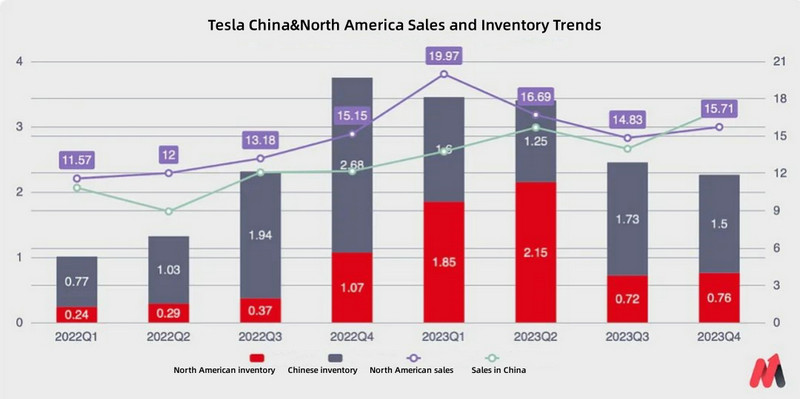

Relationship between Tesla's Sales Volume and Inventory Trends in China & North America

Relationship between Tesla's Sales Volume and Inventory Trends in China & North America

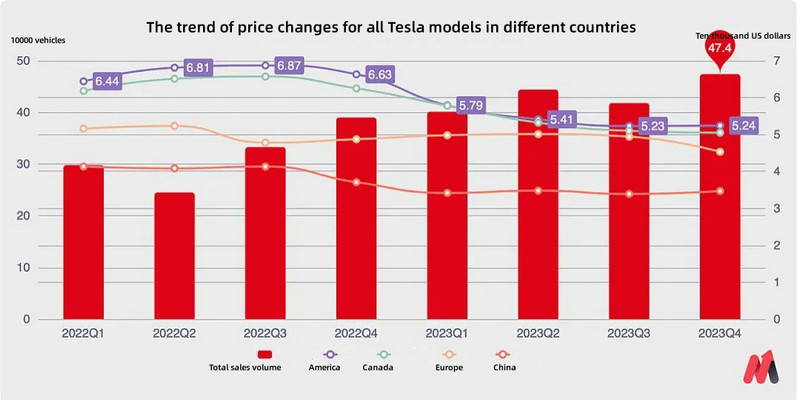

Trend of Average Selling Price per Vehicle for All Tesla Models in Various Countries

Trend of Average Selling Price per Vehicle for All Tesla Models in Various Countries

The reason for Tesla's significant self-inflicted cuts throughout the year is also straightforward: Tesla encountered lower-than-expected consumer demand in its three main markets of China, North America, and Europe, leading to a sharp increase in its own inventory (specific reasons explained in the following text). In order to stimulate sales once again and to deplete inventory, Tesla initiated a global price reduction at the end of 2022.

However, what saddens Tesla is that while prices decreased, sales volume did not increase, resulting in a natural decrease in profit.

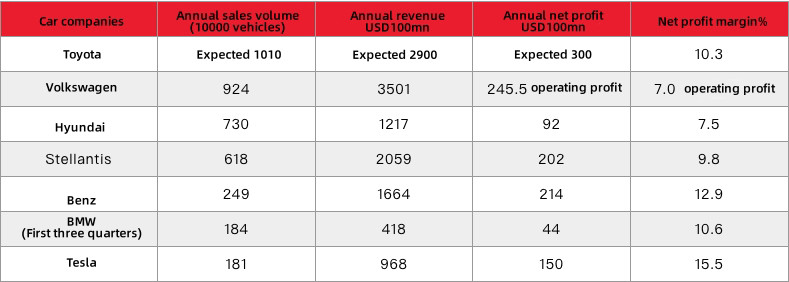

Annual Sales Volume and Revenue of Major Automotive Companies

Annual Sales Volume and Revenue of Major Automotive Companies

Tesla's poor performance in 2023, as the final result given by the market, to some extent, indicates the development trend of Tesla in the coming period. Referring to its rolling values trend, even if Tesla performs well in 2024 with a slight increase in revenue (10-13% for the year) and a narrowing decline in net profit (controlled at -15 to -20% for the year), its annual net profit level will be on par with traditional mainstream luxury car brands like Mercedes-Benz.

Being unable to significantly outperform traditional automakers in terms of operating results is becoming a "time bomb" for Tesla's current market value. It could mark the end of Tesla's overvaluation model in the past few years and even lead to a collapse in stock price in the short term.

Based on this conclusion, further exploration and analysis are still necessary: what issues have arisen in Tesla's business operations, and why has demand declined in multiple countries? Is there really no turning point for Tesla in 2024?

#01

Why did global demand for Tesla change?

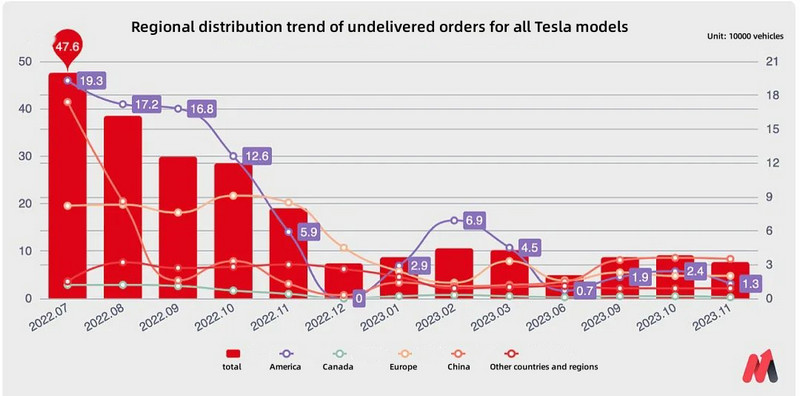

Trend of Tesla's undelivered order quantity and regional distribution

Trend of Tesla's undelivered order quantity and regional distribution

Note: Undelivered order quantity is calculated based on delivery cycles and production figures

Since the inventory in the European region cannot be statistically integrated, we can refer to the "estimated undelivered order quantity" provided by Troy Teslike, a foreign Tesla data blogger, to understand the shift in Tesla's demand. It is evident that Tesla experienced a significant decline in undelivered order quantity in China, North America, and Europe within a span of four months:

Starting in August 2022, the undelivered order quantity in China dropped from around 160,000-170,000 vehicles to a low point of slightly over 10,000 vehicles.

Starting in October 2022, the undelivered order quantity in North America plummeted from 170,000 vehicles to zero before rebounding.

Starting in December 2022, the order quantity declined from around 80,000-90,000 vehicles to only 20,000-30,000 vehicles.

These three regional markets, thousands of kilometers apart with their own market demands and consumer characteristics, experienced a demand reversal around the same time, which is not a coincidence. As domestic new energy vehicle companies continue to rise, they have brought greater market competition pressure to Tesla in the Chinese market. This has forced Europe and the United States to start curbing the pace of China's new energy industry development, seeking more time for their own automotive industries, and implementing stronger trade protection measures.

Europe and the United States, which have always advocated for green environmental protection, are now slowing down, while China, which has risen in the entire industry chain in just a few years, has squeezed Tesla in the middle. It's hard to accept.

Let's start with a specific analysis of Tesla's situation in the Chinese market.

For Tesla, the "rise of domestic new energy vehicle companies" means that the latter has formed a comprehensive market "encirclement" through more models and more refined market positioning, ultimately taking away a portion of the cake that could have been captured by Tesla.

However, at the beginning, it is necessary to correct a misconception: "Today, Tesla's products are completely uncompetitive." Taking the BYD "Han" as an example, its EV electric models directly compete with the Model 3 in terms of basic dimensions, user age orientation, performance tuning, and final price, positioning themselves as direct rivals.

The market response is interesting: After its launch in early August 2022, the Han EV initially achieved a dual advantage in product strength and price, with monthly sales exceeding 15,000 units in the fourth month. However, with Tesla's new round of price reductions, the price difference between the Model 3 and the Han EV was further narrowed, resulting in poor sales performance for the Han EV in the first half of 2023.

It was only with the official launch of the plug-in hybrid Han DM-i model in the fourth quarter that the entire series surpassed the Model 3, and even in Tesla's latest price reduction in 2024 (where the starting price of the Model 3 is still higher than the Han EV), it once again fell behind.

The Model 3, which was launched in 2017 and only received a facelift this year, is definitely unique among global automotive products.

The "virtual" duel between the Model 3 and the BYD Han series illustrates that despite Tesla's products being in the market for many years and having some shortcomings in various aspects, they still have market competitiveness thanks to factors such as brand value.

Tesla's product philosophy of "maximizing product advantages" has allowed the Model 3 and Model Y, released in 2017 and 2020 respectively, to maintain a leading position in terms of driving dynamics and intelligent features (although they have been caught up by domestic electric models). This makes them "more advanced transportation tools than most traditional fuel vehicles."

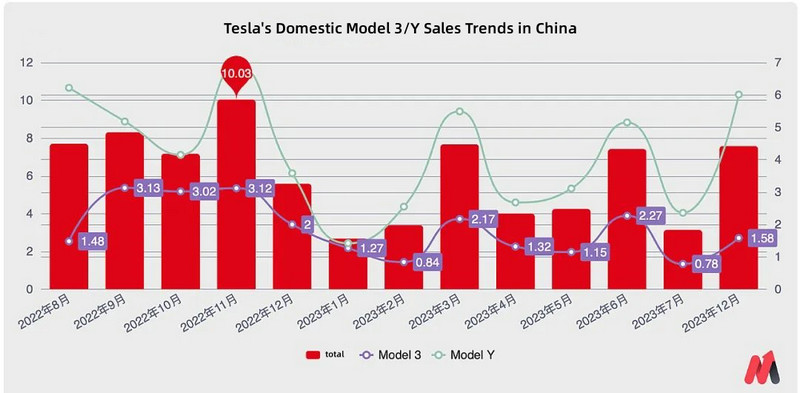

Tesla Model 3/Y sales trend in the Chinese market

Tesla Model 3/Y sales trend in the Chinese market

By adhering to the concept of creating products that are true to the attributes of transportation vehicles and combining Tesla's position as a global leader in new energy, its global market layout, and global production requirements, Tesla ultimately has no choice but to adopt a strategy of "creating popular products with a few models and reducing costs through cumulative sales."

This provides space for domestic automakers to engage in differentiated competition in terms of their products.

According to research by "Chefans," a company specializing in the automotive distribution field, during sales training sessions, manufacturers emphasize the comparison with the Model 3/Y when introducing various models, ranging from the Ideal L7, a mid-sized SUV with a starting price of over 300,000 RMB, to the more affordable BYD Song L, NIO's first crossover model, the ET5T, and the newly facelifted Jike 001.

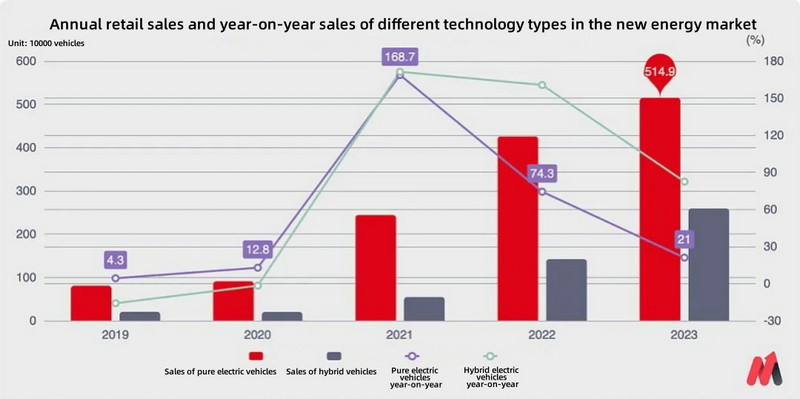

Annual retail sales volume and year-on-year growth of different types of new energy vehicles

Annual retail sales volume and year-on-year growth of different types of new energy vehicles

Chinese domestic automakers, with their product differentiation, continue to take away a portion of the "cake" that belongs to Tesla. For example, BYD, despite struggling with the sales of the Han series, has gained a significant number of customers who are interested in Tesla but have range anxiety by capitalizing on the popularity of plug-in hybrid models like the DM-i in the Chinese automotive market.

Compared to the comprehensive rise of domestic automakers in the Chinese market, Tesla faces relatively less product competition in North America and Europe.

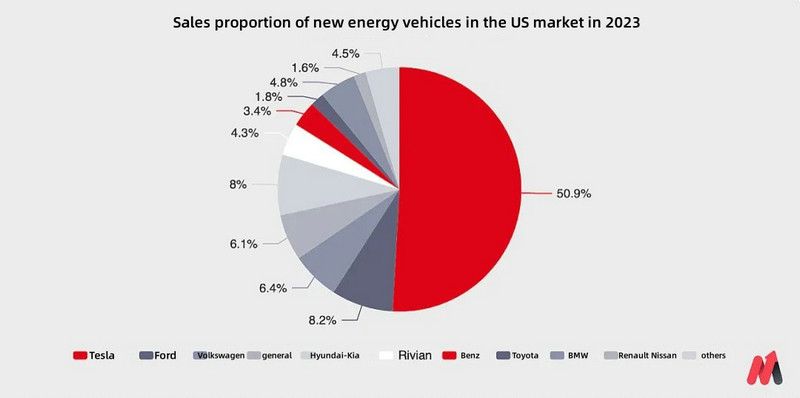

Percentage of new energy vehicle sales in the U.S. market in 2023

Percentage of new energy vehicle sales in the U.S. market in 2023

Source: Cox Automotive

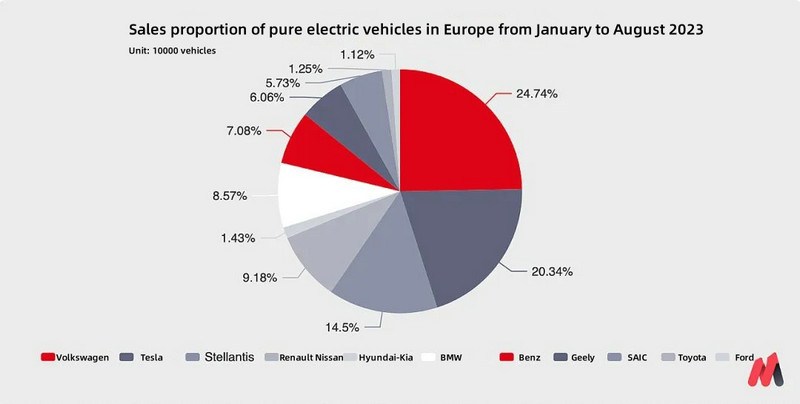

Percentage of pure electric vehicle sales in Europe from January to August 2023

Percentage of pure electric vehicle sales in Europe from January to August 2023

Source: Dataforce

Although Tesla sold over 600,000 vehicles in China in 2023, its market share was only 7.8%. In contrast, in the United States, a similar level of sales translated into dominating the entire new energy vehicle market, and even in the territory of numerous European automotive giants, Tesla still held a quarter of the market space.

With such a leading position in the market competition, one would expect consumers to have a greater preference for the brand, resulting in increased brand value. However, the reality is quite the opposite.

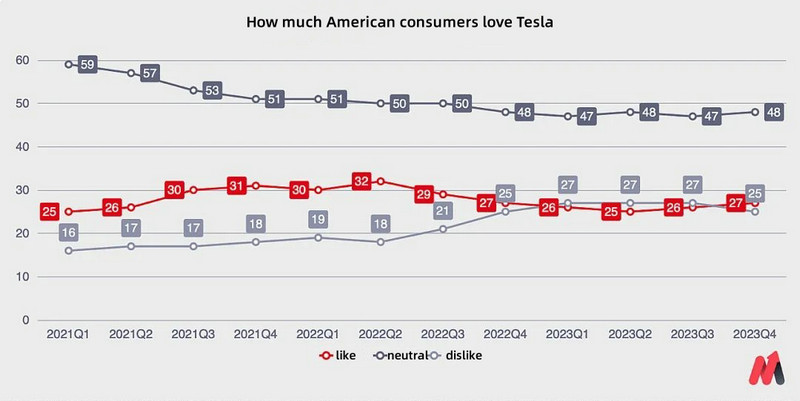

Consumer preference for Tesla in the United States

Consumer preference for Tesla in the United States

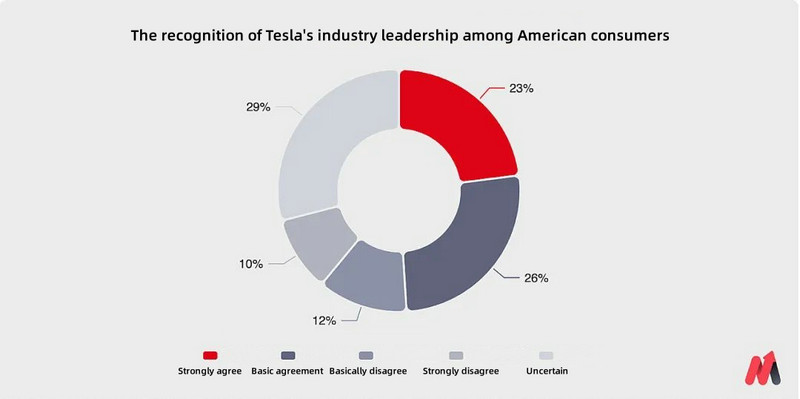

Consumer recognition of Tesla's industry leadership in the United States

Consumer recognition of Tesla's industry leadership in the United States

According to research by CivicScience, an American consumer analysis platform, Tesla experienced a significant increase in the proportion of "disliked" individuals among U.S. consumers after the second half of 2022. Furthermore, only "half and half" (49% agreement) of consumers recognized its industry leadership.

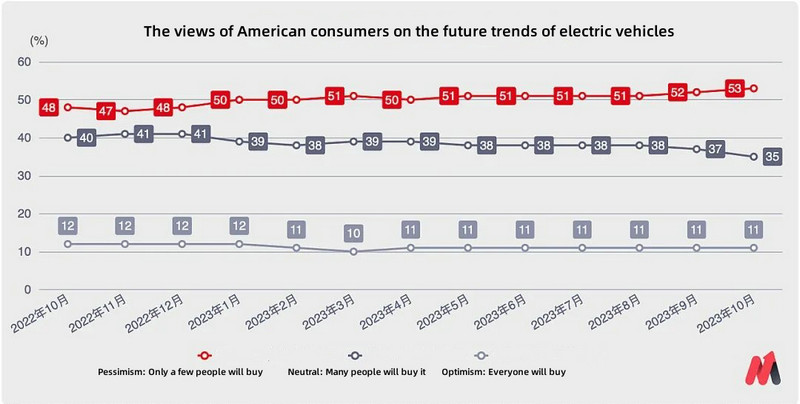

Consumer perception of the future trends of electric vehicles in the United States

Consumer perception of the future trends of electric vehicles in the United States

What is even more concerning is that American consumers are generally pessimistic about new energy vehicles as a whole. Currently, only 11% of the American car consumer population holds a sufficiently optimistic view of the future of new energy vehicles, and many of them should already be Tesla customers. Over the past year or so, an increasing number of neutral consumers have shifted towards a more pessimistic attitude.

The various announcements made by mainstream European and American automakers in the past six months serve as the best evidence:

Mercedes-Benz announced at its 2023 financial report conference that it would postpone the goal of achieving a 50% share of electric vehicle sales by 2025 to 2030 and continue to update its internal combustion engine vehicle lineup in the next decade.

At the end of last year, Audi announced that it would slow down the pace of introducing pure electric vehicles and continue to promote internal combustion engine and plug-in hybrid vehicles in the short term.

In late January of this year, Ford announced the closure of all electric vehicle production lines and a focus on the development of competitive gasoline and hybrid models.

General Motors, which had planned to increase the production capacity of electric pickups, also chose to postpone its original plans at the end of last year.

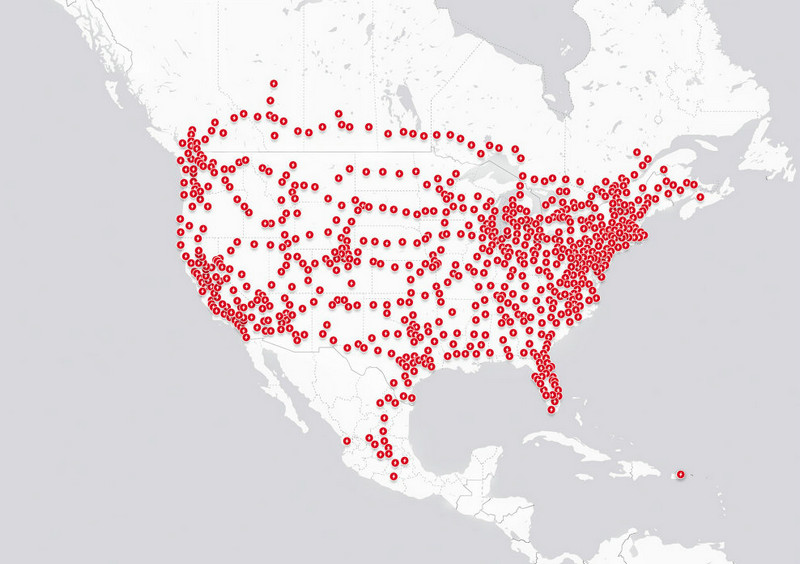

Distribution of Tesla Supercharger stations in the United States

Distribution of Tesla Supercharger stations in the United States

There are evident shortcomings in the coverage of Tesla Supercharger stations in the United States.

If the script continues to be written in this way, Tesla is likely to face a solo battle in the entire "North America + Europe" market in the near future to promote the transformation and popularization of new energy. This is clearly an untenable path. Taking Tesla's stronghold, the United States, for example, in many traditionally-minded states, even the charging infrastructure is not fully covered.

Not to mention the biggest headache for Tesla in the United States in 2024. Tesla must complete the production of power batteries in the United States for consumers to be eligible for a government subsidy of $7,500 per vehicle. While Tesla is still working tirelessly to improve its battery production capacity in the United States, Europe is experiencing a wave of subsidy withdrawal.

According to data released by the European Automobile Manufacturers' Association (ACEA) in January, electric vehicle sales in Europe (including the UK and Norway) in December 2023 fell by 16.9% year-on-year to 160,700 vehicles, marking the first monthly decline in sales since the outbreak of the COVID-19 pandemic in Europe. In Germany, the number of electric car registrations in December last year was only 54,700 vehicles, a sharp drop of 47.6% year-on-year, while the sales of plug-in hybrid models were only 17,900 vehicles, a staggering decline of 74.4% year-on-year.

The key factor behind the sharp collapse of the German new energy vehicle market is the cancellation of the electric vehicle subsidy program on January 1, 2024. Prior to this, private consumers in Germany enjoyed discounts as high as 6,750 euros per vehicle, combined with tax exemptions and other incentives provided by manufacturers. However, due to budgetary issues faced by the German government this year, the subsidy policy, which was originally planned to continue, was prematurely terminated.

In China, where policies continue to provide subsidies and guidance, the market space will further expand. However, Tesla must face the chase from domestic independent automakers. In North America and Europe, strict scrutiny or even the cessation of subsidies is squeezing the local market space, exerting sufficient pressure on Tesla, making it truly a sandwich cookie.

#02

Is there a turning point for Tesla in 2024?

Considering that we are already in the final quarter of the first quarter of 2024, and even for Tesla, it takes a relatively long period to complete adjustments, introduce new products, and increase production capacity. The only thing that can potentially impact Tesla's performance in the next three quarters is whether Tesla's existing products can be further reduced in price.

To give an answer, the likelihood is low.

Even a popular roadshow can't help Tesla

Even a popular roadshow can't help Tesla

Before delving into the pressure to reduce prices, it is necessary to mention the Cybertruck. As a product that Tesla has spent years developing and that showcases its unique innovation capabilities in the automotive industry, Cybertruck will see an increase in production capacity this year.

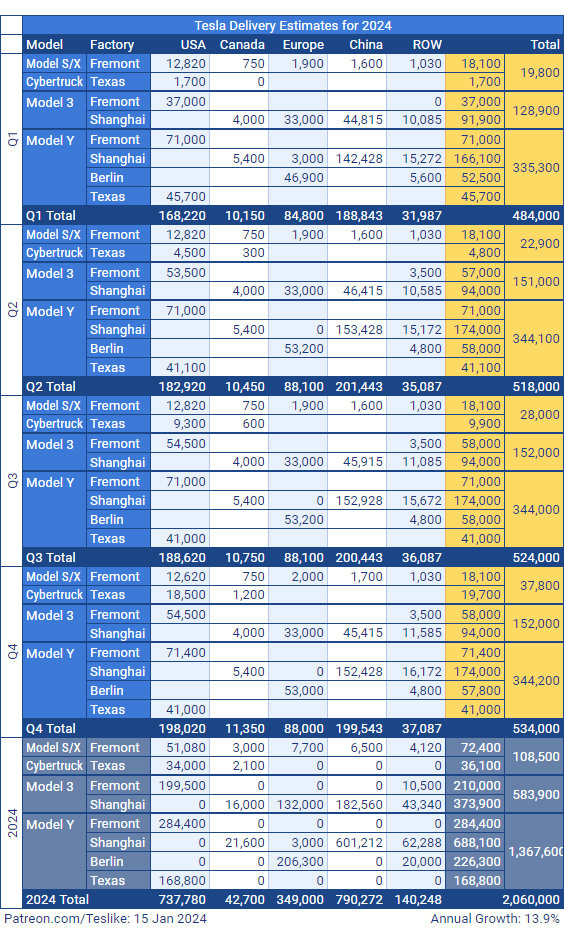

However, according to third-party tracking of Tesla vehicle chassis VIN codes, Tesla's GigaFactory in Texas produced approximately 1,700 Cybertrucks in the first quarter of 2024, which translates to only 130 vehicles per week. Based on this starting point, the industry's current forecast for Cybertruck production in 2024 is only around 37,500 units.

Even if all these vehicles are sold in North America and calculated at an average price of $75,000 per vehicle, the expected revenue for Tesla from this new car in 2024 would be less than $3 billion, which is relatively insignificant.

Tesla Delivery Estimates for 2024

Tesla Delivery Estimates for 2024

Source: Troy Teslike

Returning to Tesla's current product lineup, excluding the aforementioned Cybertruck and the Model S/X, which are expected to have a delivery volume of just over 70,000 units globally in the coming years, the remaining models are the Model 3, with an expected delivery volume of nearly 600,000 units, and the Model Y, with an expected delivery volume of nearly 1.4 million units. With no changes in the products or market selection, in order to sell all nearly 2 million Model 3/Y vehicles, the only option is to reduce prices.

The problem is that the cost of the Model 3/Y has already been reduced as much as possible. In Elon Musk's own words during an earnings call, "the cost of Tesla's existing models is approaching the limit." In simpler terms, they have squeezed out all possible cost reductions, and any further cost reductions would require significant changes.

Therefore, the next set of numbers is not difficult to calculate: Tesla's gross margin level in 2023 was approximately 17%. If the overall sales volume of its products can grow by 14% in 2024, as long as the gross margin level remains above 15%, it would require a price reduction of approximately 1.7% to achieve parity in gross and net profit results.

The offline reality is that when Tesla had a relatively high inventory at the beginning of this year in the Chinese market, it once again lowered prices, and each price reduction exceeded what we calculated above to maintain parity in gross and net profit:

The Model 3 Rear-Wheel Drive Refresh Edition was reduced by 15,500 yuan, with a starting price lowered from 261,400 yuan to 245,900 yuan, a decrease of 5.9%;

The Model 3 Long Range Refresh Edition was reduced by 11,500 yuan, with a starting price lowered from 297,400 yuan to 285,900 yuan, a decrease of 3.9%;

The Model Y Rear-Wheel Drive version was reduced by 7,500 yuan, with a starting price lowered from 266,400 yuan to 258,900 yuan, a decrease of 2.8%;

The Model Y Long Range version was reduced by 6,500 yuan, with a starting price lowered from 306,400 yuan to 299,900 yuan, a decrease of 2.1%.

Tesla's continued aggressive pricing strategy in China demonstrates that the challenges in North America and Europe are even more difficult to solve.

Let's start with the $7,500 government subsidy in the United States. Until January of this year, Tesla had to purchase 44,000 sets of lithium iron phosphate square-pack batteries for the standard version of the Model 3 from CATL every quarter. They also purchased 8,000 sets of 2170 ternary lithium batteries from LG Chem every quarter, which were used in the production of Model 3/Y in the United States and sold locally.

It will take time for this production capacity to be transferred to the United States. For consumers, Tesla is now "$7,500 more expensive." Compared to the starting price of $38,990 for the Model 3 at the end of last year and $48,490 for the Model Y Long Range version, a sudden 15-20% price increase would naturally lead to cancellations of orders.

The solution that Tesla eventually came up with was to lower the prices of the base and long-range versions of the Model 3 by $1,250 in January, and to lower the price of the Performance version of the Model Y by $2,000. Despite having a superior product in the market, Tesla still had to proactively reduce prices, and as a result, its sales volume declined. This is the real situation that Tesla faced in North America and Europe under policy adjustments.

For Tesla, which has made every effort to reduce costs in product design, manufacturing technology, and organizational management, continuing to lower prices has become the only means available at present. However, this approach ultimately has theoretical limits. Even theoretically popular models for Tesla in North America, such as the Cybertruck, and models like the Model Q that could tap into the global market through smaller dimensions, cannot escape the impact brought by the rise of China's new energy vehicle industry.

On the contrary, BYD's approach seems more worthy of Tesla's reference. The deep integration of new energy and traditional fuel technologies, as seen in the DM-i, may be more suitable for the inconsistent pace of new energy transformation in Europe, the United States, and China. The ironic reality is that moving too fast can result in punishment.

Of course, it remains a big question whether Musk, who has always been technologically progressive, will adopt the "compromise route" of hybridization.

Finally, here is a prediction. Considering Tesla's global price reduction measures and sales trends, the outlook for Tesla's performance in the full year of 2024 is not optimistic. Taking into account its production capacity and delivery estimates:

In an optimistic scenario, Tesla's gross and net profits in 2024 will remain on par with 2023.

In a neutral scenario, revenue will remain steady or experience slight growth, but net profits will decrease by an additional 10% compared to 2023.

In a pessimistic scenario, revenue is projected to decline by 10-15% compared to the previous year, and net profits could experience a drop of 25-30%.

#03

Closing Thoughts

Various signs indicate that Tesla, which has long been hailed as a "technology company" by the public, is inevitably returning to its essence as an "automobile company."

Elon Musk indeed possesses the ability to "turn decay into magic," and Tesla's 15-year journey has demonstrated its vision for the new energy revolution in the automotive industry. However, even someone as extraordinary as Musk needs to accumulate breakthroughs in foundational technology, respect the real demands of human society, and adhere to the basic principles of economics.

When we look at Tesla, we can see that products like the Model 3/Y are entering a new platform phase where the foundational technology for new energy vehicles is being realized, and the gap in basic capabilities is narrowing. Tesla's continuous attempts at vehicle autonomy still struggle to seamlessly integrate into a human-centric highway transportation network. Tesla, once mythologized and even fended off numerous Wall Street bears through growth and exceptionally high profit margins, is now experiencing a drop in business performance, approaching that of traditional automakers.

Even if these problems are not entirely caused by Tesla itself, the continuous emergence of unfavorable trends has caused retail investors to lose confidence in Tesla. The two titles that Tesla has held since 2020, namely "Retail Investors' Favorite Stock" and "Stock with the Highest Trading Volume," have been taken over by NVIDIA last month.

It appears that this time the short-selling institutions may finally triumph over Musk.

The above is the full content of Why is Tesla stock dropping?