Can BYD continue to lead Huawei in the new energy vehicle market?

Recently, Huawei released the new Wenjie M7 model, which caused some people to question BYD. They believe that smart driving will be the development direction in the next 10 years, and BYD may gradually fall behind and face sales challenges.

However, I personally believe that as long as BYD does not make big strategic mistakes, BYD is still expected to lead Huawei in terms of new energy vehicle sales in the next 10 years.

Even if intelligent driving is considered the key, BYD only needs to reach a level of 8 to 9 points in the field of intelligent driving to maintain its leading position in the market with the advantage of its full-stack self-research.

By taking care of both hardware and software, BYD has become a leader in smart cars, just like Apple is in smartphones.

As for Huawei, if it can focus on its role as a supplier, it has the opportunity to become Android or Qualcomm in the field of new energy vehicles, providing software, systems and core modules to other OEMs. But at present, it is unclear whether Huawei itself will get involved in automobile manufacturing and its future positioning.

At present, other manufacturers are afraid or unwilling to use Huawei's car software due to uncertainty about Huawei's positioning. Huawei verbally states that it does not build cars and is only a supplier, but its actions look like it intends to get involved in the field of automobile manufacturing. This makes it difficult for large car manufacturers to understand Huawei's intentions and therefore dare not rashly engage in large-scale cooperation.

In contrast, BYD has achieved certain success in the international market and has embarked on the path of international development, while Huawei has not yet fully defined its positioning in the domestic market.

Huawei's enabling delivery in the automotive field has not yet been implemented on a large scale, and this requires actual verification by consumers. At present, the various technologies promoted by Huawei have not yet been delivered in large quantities, so their true reliability, practicality, and durability cannot be verified.

In comparison, BYD already has more than 5 million car owners in the new energy vehicle field. At least in terms of safety and reliability, BYD has accumulated long-term and large amounts of real data support, which is the result of consumer empirical evidence.

Practice is the only criterion for verifying truth. Only the real delivery volume, retention volume and market share can truly represent the final choice of consumers.

When it comes to Huawei’s competitors, I have to mention Li Auto.

What is the main selling point of Li Auto sales? Is it intelligent driving? Is it a luxurious configuration? Is it an extended-range model? Or a cost-effective large SUV over 5 meters long?

BYD currently does not have a large SUV with a length of more than 5 meters (except looking up), so Li Auto's three models can be said to have almost no direct competitors. Even the Wenjie M7, which has gained some popularity in the market recently, has actually avoided direct competition with BYD products.

It can be said that almost all models that directly compete with BYD lag behind BYD in some aspects. The three models of Li Auto have cleverly avoided direct competition with BYD.

It can be seen that BYD has very strong product strength. In order not to be suppressed, it chose to find another way and avoid direct competition. This is a wise path.

If a smart car is compared to a large computer on wheels, then the performance of the computer depends not only on the software and system, but also on hardware parameters such as CPU, memory, graphics card and display resolution.

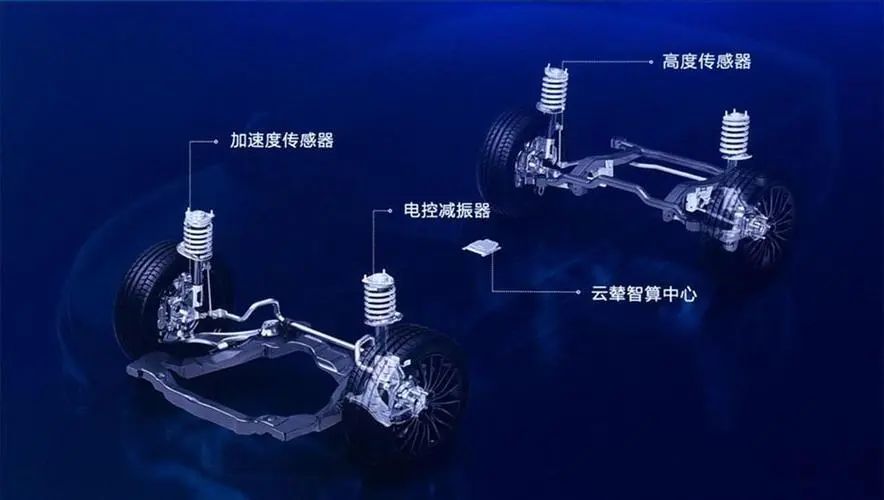

The new energy vehicle hardware technologies currently mastered by BYD, such as blade batteries, DMI and DMO hybrid systems, Yunnan intelligent suspension, Yi Sifang wheel intelligent control, emergency floatation, etc., determine that its minimum performance level is very high.

Even if BYD does not develop its own intelligent driving technology, but uses solutions from suppliers, its vehicle performance will not be bad.

At present, it seems that with its strong advantages in the entire industry chain, BYD still has a leading advantage even when facing user groups in different countries, regions and needs on a global scale.

As long as BYD avoids making major strategic and tactical mistakes, even if it cannot become Apple in the field of new energy vehicles, it is expected to become Samsung, Huawei, OV or Xiaomi in the field of new energy vehicles.

The above is the full content of Can BYD continue to lead Huawei in the new energy vehicle market?